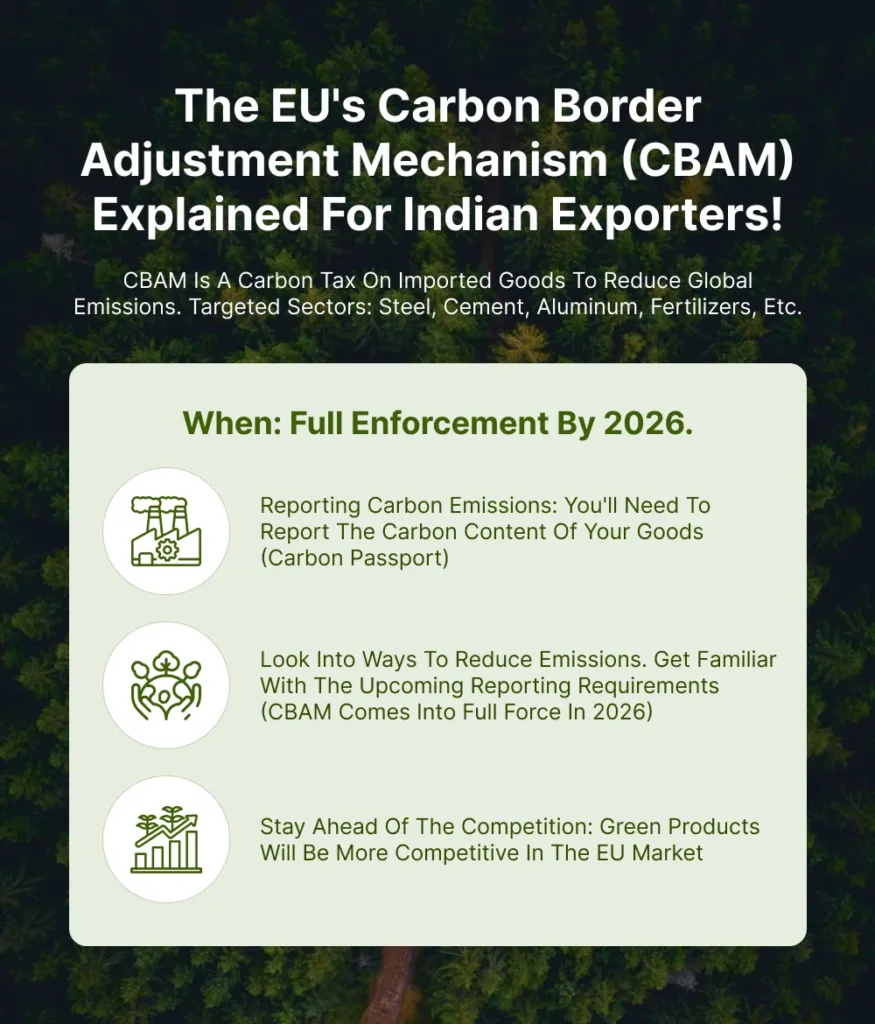

If you’re an Indian exporter, you’ve likely heard about the European Union’s Carbon Border Adjustment Mechanism (CBAM) — a policy that’s set to reshape global trade dynamics in the coming years. But what does it really mean, and how could it impact your business?

At its core, CBAM is the EU’s way of ensuring that imported goods are subject to the same carbon costs as those produced within the bloc. In other words, it’s a carbon tax on imports, designed to prevent “carbon leakage” — the relocation of carbon-intensive production to countries with less stringent climate regulations.

The mechanism currently targets high-emission sectors such as steel, cement, aluminum, fertilizers, hydrogen, and electricity, many of which represent significant export categories for India. As the EU ramps up its climate commitments under the European Green Deal, CBAM aims to create a level playing field while incentivizing cleaner production methods globally.

What This Means for Indian Businesses

For Indian exporters, CBAM brings both challenges and opportunities.

1. More Paperwork and Reporting

From October 2023, the EU introduced a transitional phase of CBAM, requiring importers to report the carbon emissions embedded in their products. For exporters, this translates to a new layer of documentation — essentially a carbon “passport” for your goods.

By 2026, when CBAM becomes fully operational, exporters will need to provide verified emissions data or risk facing default carbon values (often higher) applied by EU authorities.

2. Potential Cost Implications

Products with high carbon footprints may face an additional carbon levy, reflecting the cost that would have been paid if those goods were produced under the EU’s Emissions Trading System (ETS). This could directly affect pricing competitiveness and profit margins.

Indian companies with energy-intensive processes should start assessing how carbon costs might influence their export pricing.

3. Sustainability as a Competitive Advantage

On the upside, CBAM rewards sustainability. Exporters with lower emissions — achieved through cleaner energy, process optimization, or green technology — will hold a distinct competitive edge in the EU market. European buyers are increasingly prioritizing low-carbon supply chains, and proactive companies can position themselves as preferred partners.

4. Preparing for the Long Term

The move towards low-carbon trade is irreversible. By investing in energy efficiency, renewable energy adoption, and emission tracking systems today, Indian exporters can mitigate future risks while aligning with the global sustainability agenda. A proactive approach not only reduces compliance burdens but also enhances brand value and investor confidence.

Turning Compliance into Opportunity

Indian exporters have a unique chance to lead this green transition by integrating sustainability into their operations. Those who act early will not only ensure compliance but also strengthen their competitive positioning in a climate-conscious marketplace.

The message is clear: the future of trade is green, and India’s exporters are well-placed to turn this challenge into a catalyst for innovation, growth, and long-term resilience.